FD premature detachment fees: SBI compared to HDFC Bank against ICICI Lender vs PNB versus Sure Bank

This may range from business to organization and can end up being accommodation merely (in the uk), or trip inclusive vacations (when the traveling abroad). Do not let a straightforward transaction such as withdrawing funds from an atm end up being a method to own thieves to get the best of you. To prevent frauds […]

This may range from business to organization and can end up being accommodation merely (in the uk), or trip inclusive vacations (when the traveling abroad). Do not let a straightforward transaction such as withdrawing funds from an atm end up being a method to own thieves to get the best of you. To prevent frauds such as these, hear the new cautionary voices in mind and get cautious whenever some thing seems amiss. Despite what looks like regular issues, protect the newest guitar along with your other hand when entering the PIN—it’s really no enjoyable becoming determined to tears by a criminal activity you can have averted. As well as, for individuals who spot a fraud doing his thing, never apprehend the brand new bad guys yourself—allow the police manage you to definitely. The unit have been in portion as the ranged as the airport terminals and you will mind-provider gas heels.

There are many disadvantages so you can cracking a keen FD before it grows up. “Full, borrowing from the bank against an FD will be a good choice for those people who require immediate access to help you money during the less interest and you may instead taking any extra security. Yet not, you will need to meticulously measure the fine print away from the borrowed funds ahead of continuing,” told you Gupta.

- GOBankingRates’ editorial team try purchased bringing you objective analysis and you will suggestions.

- Some loan providers may want one look at the branch or outlet myself.

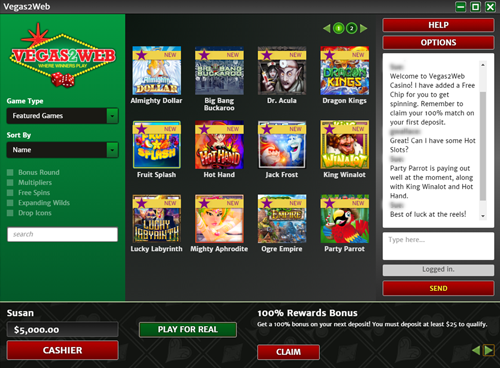

- For every twist is followed closely by the brand new whirring of the rims, the newest songs being like what you would discover if the to try out in the a technical position.

- SEC laws amendments put out July twenty four, 2014, has ‘improved’ the term a retail currency fund getting one that features principles and functions relatively built to restriction the shareholders so you can natural people.

Simply how much punishment do ICICI Financial fees to the pre-adult FD?

From the large fees, the newest duo provides made a decision to terminate its box. “We’re going with a secure flame-facts and you may flood-research home safe from today to your,” Michele says. You’re now leaving AARP.org and you will likely to an internet site . that is not work because of the AARP.

But given the rocky industry incidents out of 2008, of many performed wonder when the their cash industry finance create break the fresh buck. When you open an expression put, you are finalizing an agreement on the financial to make use of your money for its own opportunities and you will financing to own a-flat age of go out. If one makes a young detachment, you’re breaking so it arrangement as well as the financial isn’t getting the full value from the currency. Ahead of renting a secure put box, McGuinn suggests inquiring the lending company regarding their security features. The very first matter to ask, according to him, is whether the financial institution leaves consumers from the safe deposit vault on their own. “When they doing you to definitely, usually do not actually think of with a box leased indeed there,” McGuinn cautions.

- To have on the internet closure of your own FD, you should check out the online banking portal or app away from the fresh entity you to keeps your bank account.

- Abreast of their Computer game’s maturity, you have a 10-time elegance months during which you might withdraw from the Video game earlier renews for another label.

- Such profile provide competitive APYs you to definitely to alter on the market.

Abreast of the initial applicant distribution the program, next applicant will get a contact away from Judo Lender asking for them to complete the area of the application. They have to proceed with the prompts to complete its software for it shared membership. For individuals who secure interest from lender dumps, ties, or any other provide, financial institutions usually deduct TDS (income tax deducted from the supply) as soon as your attention crosses a limit. Let’s tell the truth; we all don’t very have fun with our very own discounts membership in order to the full prospective.

One to vault, supplied by https://happy-gambler.com/winward-casino/ companies such as Around the world Bank Vaults (IBV), is actually accessed because of the a corporate Goes-Royce. Visitors up coming examine the fingerprints and you can irises ahead of going in to the. The newest Civil War was just months out whenever a new york businessman titled Francis Jenks came to a proven fact that do changes the face of your banking world. If you possess the vehicle-liquidation option, then entire FD number to your maturity was paid to help you the linked checking account on the maturity.

Mobile Ports

Customers Credit Partnership Certification Membership is mainly an internet credit union, providing simply a few branch cities throughout the Illinois. Hence, which membership best suits people who find themselves more comfortable with online banking. I chose Users Borrowing Union Certification Membership because the finest alternatives for best nine-few days Cds because it also offers a competitive rate away from APY which have a good minimum balance requirements. We chosen Electronic Government Credit Relationship Typical Certificates account because the best around three-week Cd since it offers a competitive APY and certainly will become exposed having a $500 deposit. If that’s crucial that you your, find a financial you to definitely allows dollars places via Atm otherwise local locations.

I encourage trying to separate economic advice before making one financial conclusion. Before acquiring one monetary device, get and study the relevant Device Disclosure Declaration (PDS), Audience Commitment (TMD), and just about every other offer files. A revolution of identity put rate slices has hit the market this week, even while the new Reserve Lender kept the state bucks rates to your keep — contrary to traditional of big banking companies and economists. Compare higher-rates term dumps away from best Australian organization.

Most of the time, after you have drawn these fees under consideration, you could find the the fresh FD offer the fresh same or possibly lower production for the money. It might be better next that individuals make sure they will not wrap almost all their dollars right up inside fixed terminology and keep particular inside the a checking account for instant means. Surely, easily are thinking of purchasing an automobile within the next weeks, the fresh reason out of a lengthy label put would not seem sensible if you ask me. These risks tend to be nice interconnectedness ranging from and you will certainly currency field people, as well as other nice general dangers items.

Whether it’s important data, loved ones heirlooms, or jewellery, most people have confidence in the security provided by this type of packages found within this banking companies. No, our online business Name Put things have been designed as easy, hassle-free, on the internet points to allow them to’t become handled by your relationship banker for you. We’ve dependent all of our on the internet Label Places with the aim of bringing a conveniently thinking-treated feel and you will, significantly, an industry-leading rates.

Self-reliance within the interest winnings is another attractive ability out of Fixed Deposits, allowing you to choose between choosing focus in the readiness otherwise at the normal periods (month-to-month, quarterly, etc.). This allows one to customise the fresh investment to your monetary needs, regardless if you are searching for a reliable income otherwise a lump sum payment payout. Fixed Places (FDs) is a well-known collection of financing proper trying to develop its discounts securely. They provide a yes treatment for secure focus, preserving your currency secure. Although not, you should understand the Repaired Put regulations to make the most of disregard the. This guide will give you a simple rundown away from what you would like to understand, letting you build smartly chosen options to suit your economic upcoming easily.

Heavens Reports Services

Yet not, the newest Rare metal Company checking account have a level highest $step 1,100000 incentive. Once you complete the requirements, the bonus would be placed into the the brand new membership in this 60 days. When you register for its 360 Efficiency Family savings, you’ll have the opportunity to secure around $step one,five-hundred. The main benefit depends for the amount of money your deposit into your account. Offers.com.bien au brings standard information and you can research functions so you can build told monetary behavior.

Cover Your financial Protection: Crucial Methods for Pupils

Of several financial institutions play with a sliding interest size, named a good prepayment changes, however the precise words and you will decreases you’ll differ ranging from associations. Yes, both membership holder get intimate the fresh FD online when you have a combined account that have a keen “Either or Survivor” mandate. But not, when the both account holders need to concur (elizabeth.grams., a jointly manage account), you may want to check out a part to shut they, while the on the web solution might not service joint procedures associated with multiple authorizations. Depending on how the new membership works, the financial institution might need the fresh approval of any membership manager to have combined FDs (age.grams., “Sometimes Jointly” or “Either-or Survivor”). Sometimes account proprietor will get intimate the fresh FD if it is topic in order to an “Either or Survivor” mandate. In contrast, each other account holders have to accept the newest closing under Combined mandates.

Other basis to look at whenever too quickly withdrawing from your own FD is actually the effect in your income tax obligations. The eye attained in these places try taxed, plus the financial deducts the brand new taxation at the origin (TDS). On this page, we are going to discuss the consequences of damaging the repaired put before its maturity date. The new prolonged the definition of put, usually the additional money you are able to earn; just be careful that you will never you need those funds to your lock-up period of the name deposit, otherwise you get sustain certain punishment. When a phrase put is actually nearing its readiness go out, the bank carrying the new deposit will posting a page alerting the customer of your following maturity. Regarding the letter, the bank have a tendency to ask if the consumer desires the newest deposit renewed once more for the same length to maturity.